Basic Views on Corporate Governance

Our Group aims at achieving sustainable growth and maximizing the enterprise value for medium- and long-term under the management philosophy with obtaining credibility from all stakeholders surrounding us including shareholders.

We strive to strengthen corporate governance with the basic policy of following five items.

- The Company respects the rights of shareholders and ensures equality, as well as strives to improve the environment for executing rights appropriately and protect rights.

- The Company strives to sincerely cooperate with good sense with stakeholders excluding our shareholders.

- The Company strives to ensure the transparency by appropriately making disclosure according to laws and regulations and voluntarily providing information excluding the disclosure.

- The Board of Directors strives to execute its roles and duties appropriately for transparent/fair and flexible decision-making.

- The Company strives to positively communicate with shareholders after sharing the direction of its stable growth for long-term.

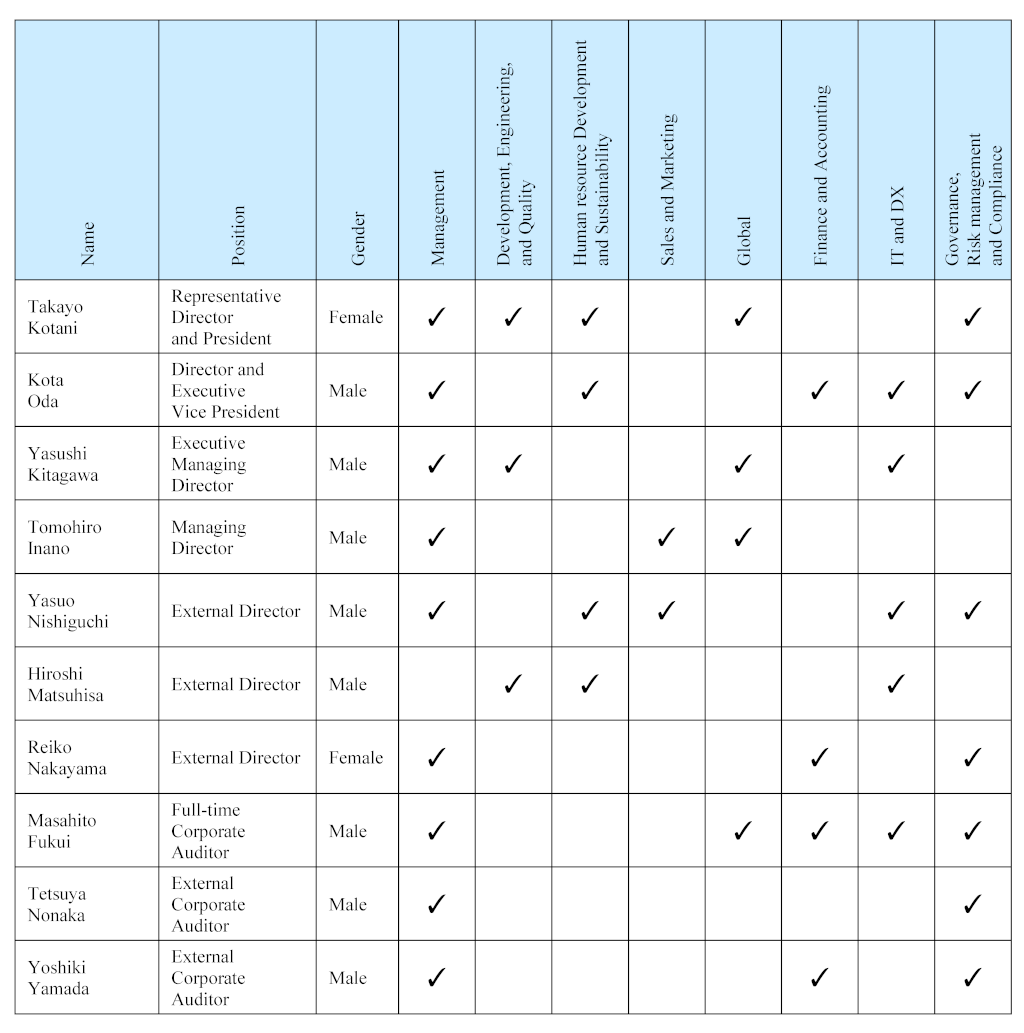

Skills Matrix

In light of our management environment and business characteristics, and in order to achieve sustainable growth in the future, we have identified the skills (knowledge, experience, and ability) that our Board of Directors should possess in order to properly perform its decision-making and management oversight functions. We will continue to review the content of the experience and skills required for our Board of Directors through dialogue with stakeholders.

Our Board of Directors is composed of members who ensure diversity in knowledge, experience, and skills. In order for the Board of Directors to make prompt and appropriate decisions and to realize a highly effective supervisory function, each Director and each Corporate Auditor will appropriately fulfill their roles and responsibilities.

This table shows the four primary skills of each personnel excluding “Management.”

This table does not show all knowledge or experience of each director and auditor.

The Board of Directors generally convenes once a month and holds extraordinary meetings as necessary. The Board determines our business execution policies and supervises the performance of directors’ duties.

Candidates for directorship are selected with an emphasis on balancing knowledge, experience, and expertise, diversity, and a global perspective, particularly in the context of a rapidly changing business environment and increasing globalization. Currently, seven directors, including external directors, serve on the Board. This size allows each director to contribute their specialized expertise while facilitating mutual exchange of opinions, enabling swift decision-making.

|

Composition |

7 directors (including 3 external directors) |

|---|

|

Meeting Frequency (FY2025) |

13 meetings |

|---|

|

Key Deliberation Items (FY2025) |

|

|---|

To further enhance the effectiveness of the Board of Directors, we conduct an survey to analyze and evaluate the overall effectiveness of the Board. We analyze and assess the results and implement improvements. This survey is conducted annually for all directors and corporate auditors. We also accept open-ended comments to identify specific issues and opinions. The survey conducted in January 2025 identified areas for improvement regarding agenda setting. Agenda setting was also highlighted as an issue in the previous survey, and we have been continuously working on improvements since last year. As a result, the evaluation score has improved compared to the previous survey. However, we will continue to strive for improvement in areas where the results are not yet sufficient.

|

Board Effectiveness Questionnaire Evaluation Items |

|---|

|

Our company has adopted the Board of Corporate Auditors system. The Board of Corporate Auditors holds regular meetings and convenes special meetings as necessary. Furthermore, all auditors attend the Board of Directors meetings. The full-time corporate auditor maintains a system that allows him to constantly monitor the directors’ execution of duties. This is achieved through attendance at the Board of Directors meetings and other important meetings such as management meetings, as well as through investigations into the status of operations and assets. Information regarding the content of important internal meetings is communicated to the external corporate auditors via the full-time corporate auditor. Furthermore, the full-time corporate auditor actively exchanges information and opinions with the Internal Audit Office and the accounting auditors as needed to enhance the audit function.

|

Composition |

3 corporate auditors (including 2 external corporate auditors) |

|---|

|

Meeting Frequency (FY2025) |

13 meetings |

|---|

|

Key Deliberation Items (FY2025) |

|

|---|

YUSHIN has the Nomination and Remuneration Committee as the advisory body for the Board of Directors to reinforce fairness, transparency, and objectivity of the procedure to nominate the board members, set the remunerations, and others. Right now, Yasuo Nishiguchi (External Director) chairs the committee where three members sit: Takayo Kotani (Representative Director and President), Hiroshi Matsuhisa (External Director), and Reiko Nakayama (External Director), which makes four in total.

|

Composition |

4 directors (including 3 external directors) |

|---|

|

Meeting Frequency (FY2025) |

1 meeting |

|---|

|

Key Deliberation Items (FY2025) |

|

|---|

- Lunch Meetings

Following each monthly board meeting, we hold “Lunch Meetings” utilizing the lunch hour. Department heads report on various topics, followed by active discussions based on these reports. External directors have commented, “Receiving reports on internal initiatives and challenges helps us understand the company’s issues.” - Implementation of Various Training Programs

We conduct various training programs, including factory tours, based on the expected roles, responsibilities, and required qualities and knowledge. - Advance Distribution of Board Meeting Materials

To enhance the quality of discussions at board meetings, materials concerning agenda items and matters to be reported at the board meeting are distributed in advance.

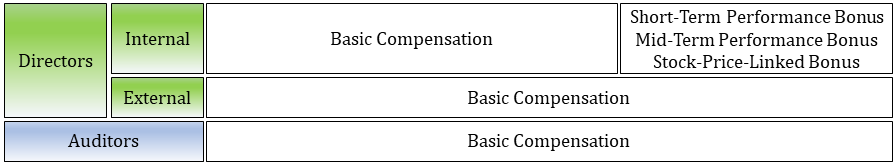

The Board Members’ Compensation System

Our board members’ compensation system is aimed at improving motivation for improving performance and securing and retaining excellent human resources, for the sustainable growth and enhancement of competitiveness of YUSHIN. YUSHIN has decided a new policy for the board members’ compensation at the board meeting held on March 7th, 2022. Nomination and Remuneration Committee accepted the consultations and approved the decision.

[ Key Features of the System ]

- Setting compensation standard in reference to industry standards.

- Strengthening efforts to improve mid-term performance and to drive up the stock price.

- Improving objectivity and fairness in compensation deciding process.

The board members’ compensation consists of monthly compensation (basic compensation), short-term performance bonuses, and mid-term performance bonuses and stock-price-linked bonuses.

Monthly compensation (basic compensation) is determined by the Representative Director and President, who is delegated by the Board of Directors, based on the evaluation of Directors determined through deliberation by the Nomination and Remuneration Committee within the monthly remuneration range (upper and lower limits) for each position. Short-term performance bonuses are determined by multiplying the base salary of the position by a performance coefficient based on the achievement of the consolidated Ordinary profit, and by reflecting the overall contribution of the Directors based on target management and qualitative assessment. The mid-term performance bonuses and stock-price-linked bonuses are decided by reflecting two coefficients - mid-term performance coefficient based on the growing rate of earning per share (EPS), and stock-price-linked coefficient based on the growing rate of the stock price.

The makeup of the compensation is determined by position with reference to the external standards of the companies in the same industry and of the same size as the Company (the total of short-term performance bonus and medium-term performance/stock-price-linked bonus is approximately 30%).

The compensation for External Directors and Auditors consists of fixed compensation (basic compensation). It is our policy not to pay performance-linked compensations in order to maintain independence in the conduct of business.

- 拡大

- Board Members’ Compensation System in YUSHIN